Where Do Global Emissions Stand, 10 Years After The Paris Climate Agreement?

As we mark a decade since the historic Paris Agreement, it's crucial to reflect on where we stand in the global fight against climate change. While the agreement was hailed as a turning point in global climate action, the latest data presents a sobering picture. In this article, we’ll dive into the current state of emissions, what has been achieved in the past decade, and where the world is heading.

The Paris Agreement marked a bold beginning

When the Paris Agreement was signed in 2015, it was a bold declaration by 195 countries to limit global temperature rise to well below 2°C above pre-industrial levels, with an aspiration to limit it to 1.5°C. This marked a monumental shift in global climate policy, acknowledging the need for urgent and sustained action to address the climate crisis.

However, ten years on, we find ourselves at a critical juncture. The world has made strides, but as recent data reveals, the path to a sustainable future remains fraught with challenges.

Global emission trends

According to the latest data and analysis, global greenhouse gas emissions have continued to rise despite efforts outlined in the Paris Agreement. This is particularly evident in the following key findings:

1. Hottest Decade Ever Recorded

The past decade (2015-2024) was the hottest on record, with 2025 set to be the second or third warmest year recorded. The surge in global temperatures directly correlates with the increase in greenhouse gas emissions, primarily driven by fossil fuel combustion, deforestation, and industrial activities.

2. Rising Greenhouse Gas Concentrations

Carbon dioxide (CO2) concentrations have reached historic highs, continuing their upward trajectory since 2015. This is concerning because CO2 is the primary greenhouse gas responsible for global warming, and its rising concentrations further cement the need for radical changes in global energy systems (Earth.Org, 2025).

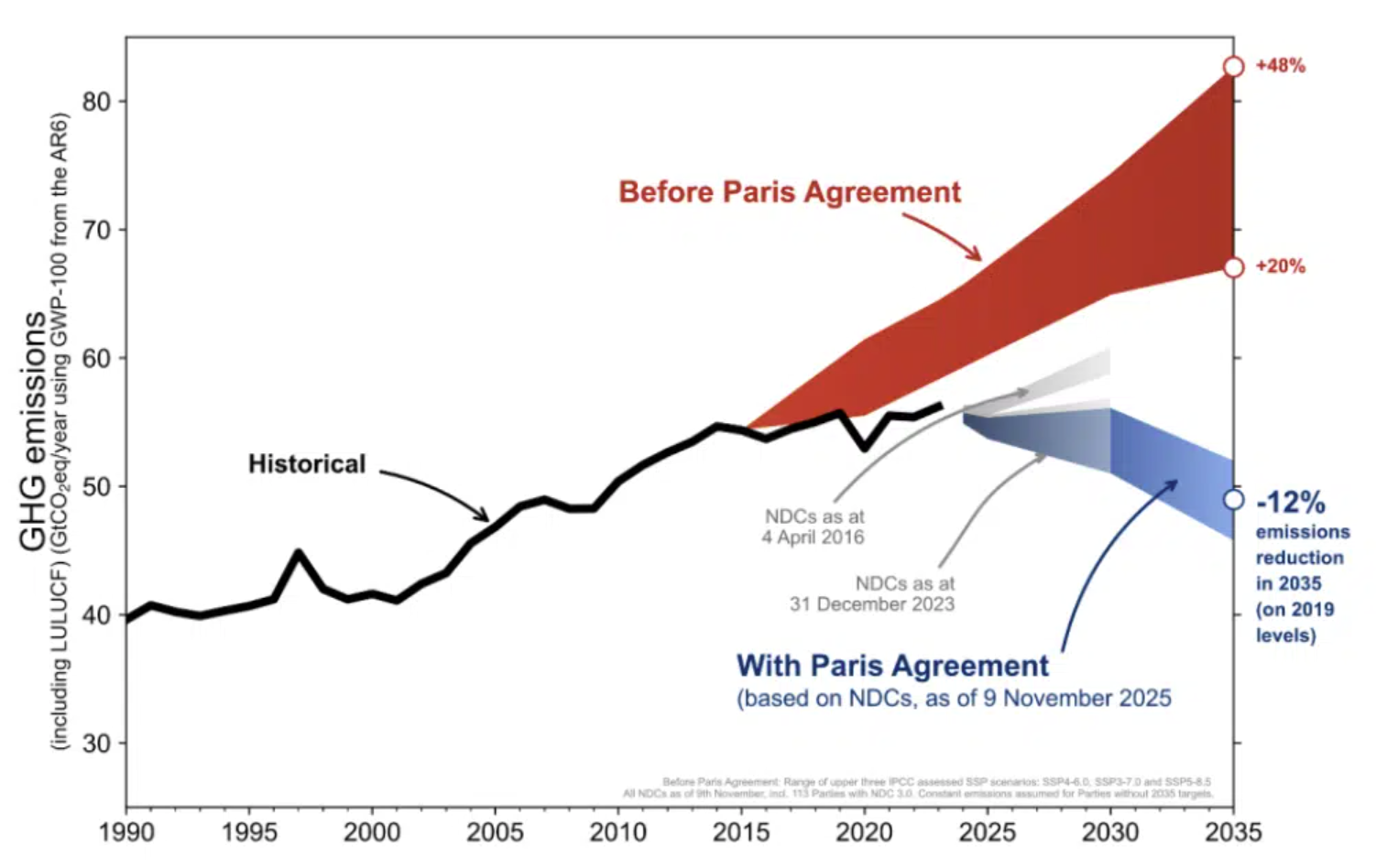

Image Source: UNFCCC

3. The Emissions Curve: A Turning Point?

A key takeaway from recent analysis is that for the first time, global emissions appear to be bending downwards, as displayed in the graph by UNFCCC. While the pre-Paris trajectory suggested a steep increase in emissions, the efforts driven by the Paris Agreement and national climate policies are now beginning to show some impact. Still, the emissions reductions projected by current Nationally Determined Contributions (NDCs) are insufficient to meet the 1.5°C goal (Earth.Org, 2025).

4. Global Warming: Ahead of Schedule

One of the more alarming developments is the acceleration of global warming. The planet is now 1.41°C warmer than pre-industrial levels, and we are on track to reach the critical 1.5°C threshold as early as March 2029, nearly 13 years earlier than previously expected. This highlights the urgent need for increased global action to slow the rate of warming (Earth.Org, 2025).

Looking ahead

While the agreement has provided a framework for climate action, the gap between ambition and implementation remains significant. It also points out that the economic shift toward greener energy sources has been slower than needed, with fossil fuel subsidies still prevalent in many parts of the world (World Ports Org., 2025).

First, retirements are rising fast, and retirement income is becoming a whole system challenge. The paper notes Australia’s super pool is now over $4 trillion and highlights the scale of Australians moving into retirement over the next decade (MLC, 2025). This matters because the decisions retirees make in the first few years can shape their lifestyle for decades.

Second, confidence is low and that changes behaviour. Only 34% of Australians feel financially confident, and many expect to rely on the Age Pension (MLC, 2025). The paper also shows advised Australians report stronger wellbeing and preparedness than those without advice (MLC, 2025). A lack of confidence often leads to either spending too little, holding too much cash for too long, or making sudden changes when markets wobble.

Third, retirement is often longer than people plan for, especially for couples. Life expectancy at age 65 is higher than many assume, and for couples there is a meaningful chance one partner lives into their 90s (MLC, 2025). Planning for “average” can leave people exposed, especially if care costs rise or one partner is left managing finances alone.

Finally, the paper says most retirement outcomes come down to managing four predictable risks (MLC, 2025). These are market falls around retirement, living longer than expected, inflation over time, and emotional decision-making that leads to underspending or panic moves.

5 practical actions you can take to be prepared

Start by planning around income rather than your super balance. Estimate your essentials first, then add lifestyle spending, then add a buffer for surprises. A simple way to do this is to map your spending into three buckets. Needs, wants and contingency. This becomes your “income target” and improves decision-making quickly.

Make the early years of retirement a priority. The paper highlights sequencing risk as most dangerous around the retirement transition (MLC, 2025). In practice, that means thinking about how you will fund the first few years of spending without being forced to sell growth assets during a downturn. Your strategy should match your cashflow needs and your comfort during volatile periods.

Give your money jobs using a layering approach. The paper supports separating money for basics, buffers, lifestyle and legacy (MLC, 2025). Practically, this can look like ensuring your essentials are covered first, then keeping a dedicated buffer for health costs and big one-offs, then allowing a defined lifestyle amount you can spend guilt-free, and finally deciding what you want to preserve for family or giving. This approach often reduces anxiety because it makes your plan feel more predictable.

Bring Age Pension planning into the picture earlier than most people do. The paper notes many Australians expect to rely on it (MLC, 2025). Even if you think you will not qualify, it is worth understanding how eligibility works and how it might interact with your retirement timing, your drawdown approach, and how assets are held. Early modelling can change decisions you make years before retirement.

Do the final step that most people avoid until it’s urgent. Get professional advice. Retirement income strategy is a specialised area because it combines cashflow design, risk management, tax, super rules, and social security. A qualified financial adviser can help you stress-test your plan against longevity, inflation, and market shocks, and give you a clear strategy you can follow with confidence. It is also a strong way to avoid the common trap the paper highlights, which is underspending out of fear, even when you can afford a better retirement (MLC, 2025).

References

Earth.Org (2025). Carbon dioxide levels increase by record amount to new highs in 2024. https://wmo.int/news/media-centre/carbon-dioxide-levels-increase-record-amount-new-highs-2024

MLC (2025). Riding the retirement wave: Getting Australia ready. https://myexpand.com.au/_doc/expand-riding-the-retirement-wave-white-paper?utm_campaign=expand_retirementboost_whitepaper&utm_source=linkedin&utm_medium=linkedin&utm_content=carousel

World Ports Org. (2025). Global emissions reach record high amid widening gap between climate policy ambition and implementation. https://www.worldports.org/global-emissions-reach-record-high-amid-widening-gap-between-climate-policy-ambition-and-implementation